“For most of my life, I’ve felt that there must be more to our existence…it’s strange to think that you accumulate all this experience, and maybe a little wisdom, and it just goes away.

So, I really want to believe that something survives, that maybe your consciousness endures. Nut on the other hand, perhaps it’s like an on-off switch. Click and you are gone. Maybe that’s why I did not put an on-off button on the iPhone”

- Steve Jobs

Yes, most of what you do, what you experience, what you go through, people, relationships, experiences, memories, will go once you are gone.

The questions then are how you center yourself and focus on the purpose of your journey.

What’s Important?

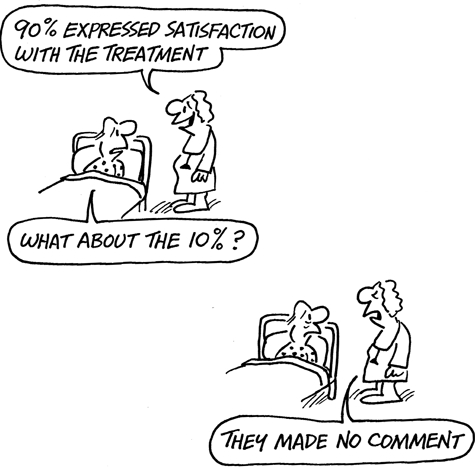

The ability of the illusion to win over the real is larger than what anyone can imagine.

Ultimately, we all see ourselves as rational being.

It’s always the other side of the debate that is irrational.

The thing becomes the center over what makes the thing worthwhile.

The outcome drives the journey more than the journey itself.

The false notion of personal satisfaction becomes more important than what gives work true meaning.

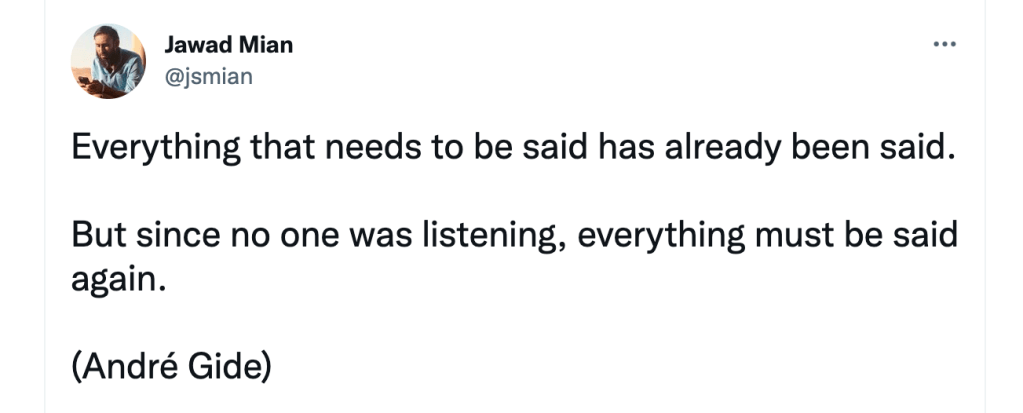

Unfortunately, this has not changed and is hardly likely to change because you are reading this blog.

Cause ultimately the world can only see the on/off button and not what’s behind it and till that doesn’t change we will keep chasing the last mile even though the joy that comes with the achievement might not last the mile.

The Lifecycle

Business focuses on gradual accumulation of intrinsic value, derived from the ability of our publicly owned corporations to produce the goods and services that our consumers and savers demand, to compete effectively, to thrive on entrepreneurship, and to capitalize on change. Business adds value to our society, and to the wealth of our investors.

When you think about investing your time and your money in this way, it gives you a lot answers.

The key words are-gradual, accumulation, intrinsic, produce, effectively.

Are we thinking about what we do in this fashion-gradual accumulation of intrinsic value to produce effectively

There is the key.

The tangible “Outcome” is a moment in this journey.

Rest all is work which creates the meaning that results into this outcome but is mostly “intangible”.

Enough

At a party given by a billionaire on Shelter Island, Kurt Vonnegut informs his pal, Joseph Heller, that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular novel catch-22 over its whole history. Heller responds, “Yes, but I have something he will never have… enough

Thank you for reading