Mohammed Bouazizi, 26, sold fruit and vegetables illegally in Sidi Bouzid, Tunisia because he could not find a job.

Every day, he would get harassed by the corrupt policemen who would take away his day’s earnings.

December 17, 2010 as once again the police harassed him taking his wares away, he decided to self-immolate himself triggering a multi-year arab spring revolution across the middle-east leading to unseating of such powerful dictators as Col Gaddaffi in Libya to Hosni Mubarak in Egypt.

A self-immolation in one small town of a little country igniting a revolution in a large part of the world is unimaginable.

However, triggers work that way.

Triggered

A large number of decisions on day-to-day basis get triggered sometimes by months and at times by years of bubbles that are building in and around people.

The global equity market-cap as on Dec-19 was 93Tn USD.

As we progressed to March-20, this declined by over 30%.

However, at the end of Dec-20, the market cap was up 17% over Dec-2019 reaching 109 Tn USD and stands at 120 Tn USD as at end of July-21.

A lot of investors not only imagined a global catastrophe and hence a large and enduring decline in the stock markets, but they pulled out actively and went into cash.

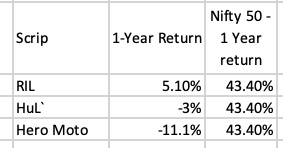

The interesting part is that in 2019 global equities had done very well with market cap going up by almost 20%

Which means share prices were already higher by every kind of valuation metrics.

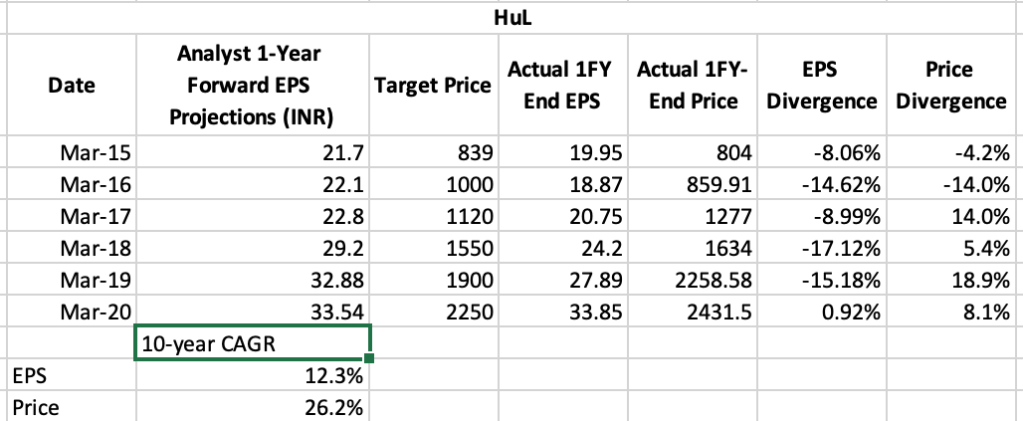

The fact that investor decided to pull out in March 20 and came back subsequently when the markets recovered taking the markets to even bigger highs constitute the “behaviour gap” that impacts investor returns.

Risk Perception

It is well known that it’s not the actual risk but its perception that defines investor behaviour.

Which in turn determines cash flows in the markets.

Cash flow-both in/out will in turn determine volatility in performance.

Volatility in turn will determine “The Gap” between fund returns and the investor returns.

Investor Mindset

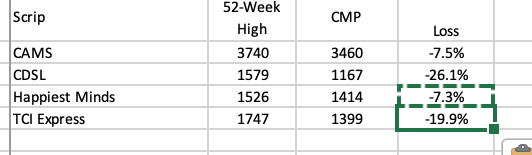

“Risk” has to be seen as permanent loss of capital and not just mark to market losses.

What seems like sunk cost in the short-run is actually the investment that can pay-off provided as an investor you have a process and philosophy around what you are trying to achieve.

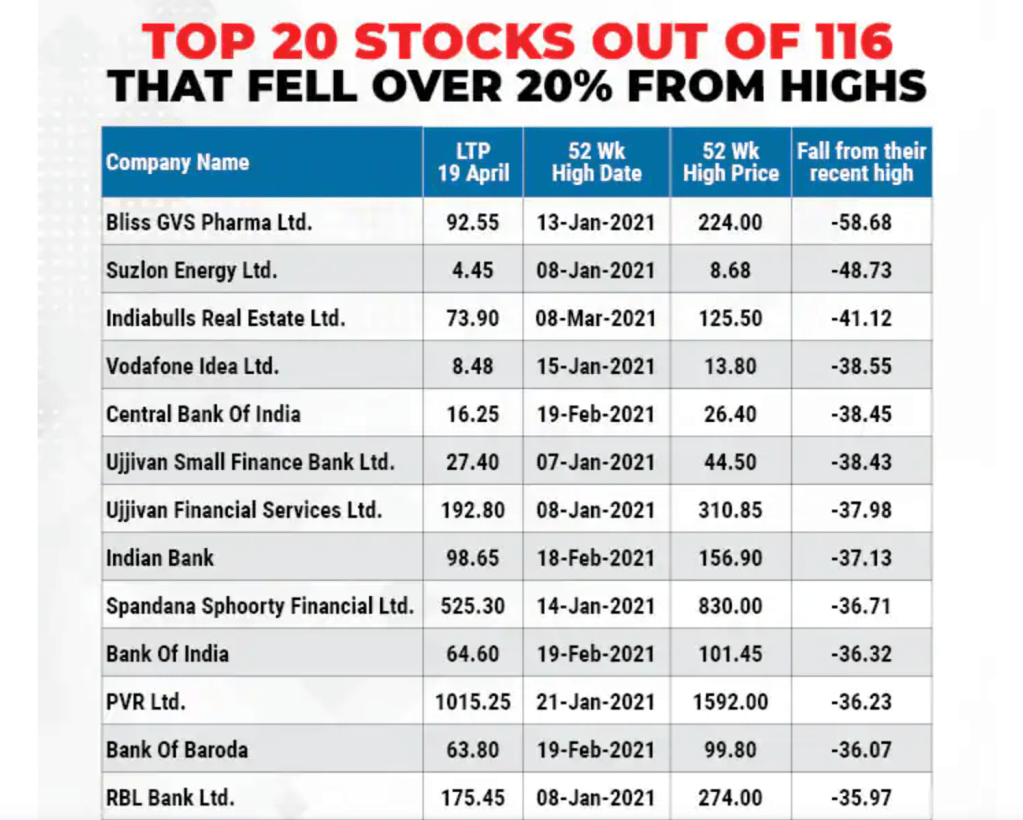

Often heard complaint from investors is that the markets are expensive.

However when the markets fall, they start worrying about getting into a “value trap”.

This takes a very linear view of how the larges universe is operating.

While it is OK at times to look at “0”/”1” scenarios, it is also worthwhile to consider the merits of businesses/investments that you own and how they shall get impacted and take a slightly longer-term view of your investments.

Here are some suggestions to think about:

- How much loss can I take on my portfolio and on individual components?

- What would the world need during a particular crisis? Which businesses can benefit from that need, and do I own such businesses?

- Instead of pulling out of the markets, should I re-orient my portfolio?

- Are there businesses in my portfolio that see their businesses continue despite the crisis/recession and other negative factors; how’s is their balance sheet, can they raise money, can they survive the crisis?

- Take help from experts

End of the day, “fear” is necessary and it prompts you to take actions.

However what is even more important is “calm” so that you take the right action and not just take “A action”

Happy investing-follow my twitter handle @manver1974 for more such shares