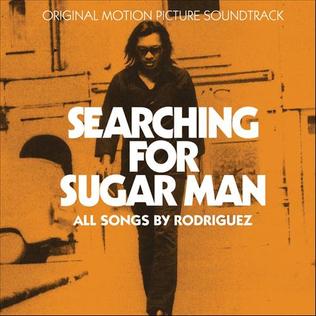

Sixto Rodrigues, an American musician released 2 albums in the 1970’s which bombed so badly that he landed up eventually in construction work.

However, as it often happens, 2 South African lads travelling to America found his albums, loved them, took it along to South Africa.

There the shared the music with friends and families leading to Rodrigues becoming a cult success in South Africa.

Eventually Malik Bendjelloul made an Oscar winning documentary on this phenomenon giving a second lease of life to Sixto.

Sebastian Mallaby, the author of Power Law, describes this as the ultimate example of how success begets success. A sort of 2 parallel world where you succeed in one while failing in the other ones.

How the network effect got created for Sixto when these South African men shared the album in their home country and without him knowing or even trying to create it.

Influences

Mathew Salganik created the Musiclab experiment in 2004.

Where he enrolled 14000 participants to download and listen to songs.

Participants were divided in 2 groups:

- 1st group received additional information on number of times the song had been downloaded

Additionally, they were divided into 8 groups where they would keep getting additional information on what their group was downloading

- 2nd group got songs with only song title and band names

The results were interesting

- In the Group 2-where decision making was independent, the result was predictable, popular songs became more popular and unpopular songs were less popular

- However, in the Group 1, while the popular songs never did very badly and the unpopular songs never came out on the top, literally anything else was possible.

- The success of the song depended upon its ranking along with its quality

Success begets more success and so can failure

Think of a movie director whose first film becomes a big success.

Take M. Night Shyamalan for instance.

Sixth Sense was a big hit, nominated for 6 Oscars including one for best director.

Everybody expected big things from him.

He was compared to Steven Spielberg.

But then it all became too predictable and coming to a situation where these days his name is not even being mentioned on the marketing material of his films.

What the makers are trying to avoid is exactly what the Musiclab experiment achieved.

If his name comes up, scores of people might opt not to even watch the movie expecting the predictable even though he positioned himself for unpredictability.

Without his name the movie might make big dollars which let’s say “The Last Airbender” did.

Social Influence or the Herd Tribe

Change can happen in 3 ways

- By Rational argument

- By Force, or

- By Influence

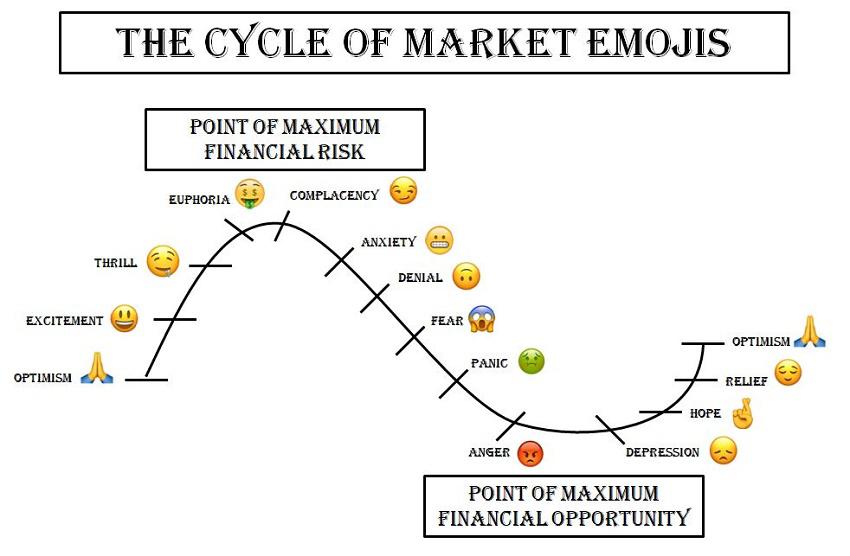

Think about investors investing basis Reddit forums or taking tips from family and friends.

The comfort of doing something which someone known to you is already doing makes you skip the hard work that goes into a decision.

So, while you avoid the hard work and feel happy knowing you are doing what some or lot of other people like you are into, you could lose time, money and get stress in bargain.

The network effect can be good when trying to grow a business or even creating s social movement around a worthy cause.

However, whether it is about buying a product, investing in a business, or participating in a social movement, your own thought process, rationale and objectives should be in place, lest you become the “Sugar man” yourself-failing in one place and succeeding somewhere else purely randomly and not by design.

Of-course there can be no design, if you didn’t even make an effort to design.

By the way there is nothing wrong in getting influenced, till the ultimate decision has your finger-prints on it.

Thank you for Reading

Follow my Twitter handle @manver1974 for more such shares