Here is a story on how some online brokerages are using social media influencers.

One of the good things about investing is there is no right or wrong.

What works for you is right for you.

So, checking out some of these influencers you can see the audience for which it might work.

What kind of advice are you looking for is also very critical aspect to consider.

How does it work?

Academics will teach you that there are 3 methods to change behavior:

- Dictate change-works for a while but doesn’t make every lasting change

- Argue change-you might win the argument but not the change

- Influence change –

- There are individuals around everyone who are either respected, envied or competed against.

- These are your influencers by design or not.

Is it Healthy?

As a marketing technique it is great to create an influencer campaign.

It might even convert into business.

Remember “Influencers” are there for a reason.

They give you comfort and sense of relatability.

Like with everything understanding how you use an influencer and who is the right influence can help.

When you deal with someone who doesn’t have the background to understand technicalities of financial investing, the whole idea is to simplify the campaign.

“Simple” and “Simplistic” are separated by a fine line.

It is always easy to take one part of the equation and amplify it.

However, financials decisions are about setting the context right.

Now that is time consuming, and no IGTV/Reel’s content can do justice.

The easiest route then is to dish out simplistic advice and product pushing.

There is a PR element to every company that helps it be seen as an ethical/interested in customer well-being/communities etc., kind of company, and then

There is real business to be done.

I would love to have consultative sales process, unfortunately it is too time consuming and expensive so go and do the easy thing to push products.

Influencers come handy here.

Is that the kind of Influencer you want to follow?

Easy Way Out

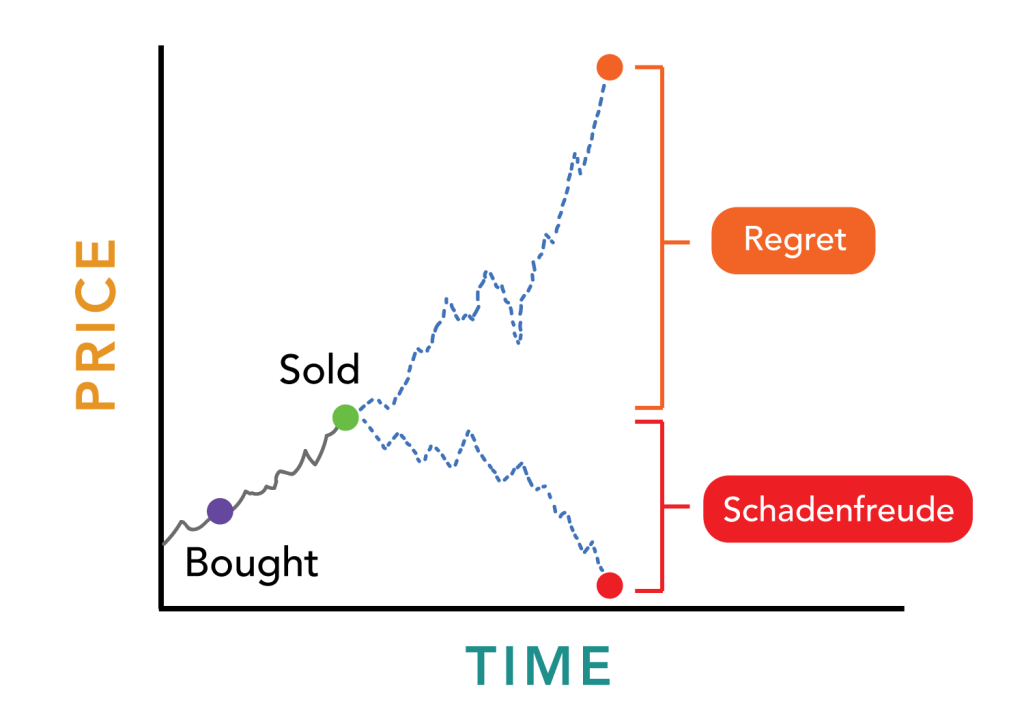

Individual investors as we have discussed earlier have a complex relationship with investing.

It is also driven by the same factors that create influencers.

- X person invested in so and so, which did well so I should also do the same

- X person has made so much money is Y investment, I am more intelligent than s/he, I will also do that same

Remember this:

As an investor one is looking for easier answers and simpler ways to take a decision, however investing is serious business.

You will get the easy answers and simple ways after putting in the effort.

It’s like once you learn driving it seems simpler but till you do, you are scared to touch the wheels.

Now serious investing takes efforts at understanding

- Yourself

- Your financial needs

- Your ability to take risk

- Your time frame

- Take the effort to Understand what you are investing in and what are the risks associated (and don’t’ say I will not invest in what I don’t understand)

Tough ask, so what’s the easiest way out.

Be a Follower.

Should you be a Follower

Being a follower in social, professional, religious or politics is driven by beliefs or needs.

However, in investing the leader and follower might be playing completely different ballgame.

The leader’s knowledge, ability to understand risk, margin of safety, timing, information network, liquidity and timing of exit are neither known to you in advance nor on your horizon.

By the time you realize something has been done by the leader, the “ship might have already sailed”.

However if you have answered all the questions listed above, you might be able to differentiate between the applicability of what an influencer is saying for yourself and that’s really where you wish to reach.

There is no shortcut

Yes, you could track and listen to the influencer and their moves but remember “investing is not one size fits all”.

You need a guide who can put what you need, you listen into the context of your circumstances.

For ideas/guidance contact on manish.verma@manishverma.co.in +919920741569

Follow my twitter handle irreverentinvestor @manver1974